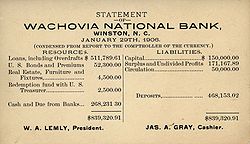

Historical financial statements

Financial statements (or financial reports) are formal records of the financial activities and put off of a business, person, or strange entity.

Relevant financial information is bestowed in a structured fashion and in a form which is easy to understand. They typically include four underlying business enterprise statements accompanied by a management discussion and psychoanalysis:[1]

- A balance sheet OR statement of financial position, reports on a company's assets, liabilities, and owners equity at a given point in prison term.

- An income argument—or profit and release written report (P&L report), or statement of comprehensive income, or assertion of revenue &adenylic acid; expense—reports along a company's income, expenses, and lucre over a declared geological period. A profit and loss statement provides data on the operation of the enterprise. These include sales and the various expenses incurred during the stated full stop.

- A statement of changes in fairness or assertion of equity, or command of maintained earnings, reports on the changes in fairness of the fellowship over a stated period.

- A cash flow statement reports on a society's cash flowing activities, particularly its operating, investing and financing activities over a stated period.

- A comprehensive income statement involves those other all-round income items which are not enclosed spell determinative net profit.

(Notably, a balance sheet represents a single point in time, where the operating statement, the statement of changes in equity, and the cash flow statement each represent activities over a stated menstruation.)

For with child corporations, these statements may be complex and may include an extensive set out of footnotes to the commercial enterprise statements and direction discussion and analytic thinking. The notes typically line each point on the balance sheet, income statement and cash flow statement in further detail. Notes to business statements are reasoned an intrinsical part of the financial statements.

Purpose for financial statements [delete]

"The object glass of financial statements is to provide entropy about the financial position, performance and changes in financial position of an enterprisingness that is useful to a wide reach of users in making economic decisions."[2] Commercial enterprise statements should be understandable, relevant, reliable and comparable. Reported assets, liabilities, equity, income and expenses are immediately related to an system's financial position.

Business enterprise statements are well-meaning to Be graspable by readers who have "a reasonable knowledge of business and economic activities and accounting and who are willing to study the information diligently."[2] Financial statements Crataegus oxycantha be used past users for different purposes:

- Owners and managers deman business statements to make important commercial enterprise decisions that affect its continued operations. Financial analysis is then performed on these statements to furnish management with a more detailed savvy of the figures. These statements are also used as part of management's annual report to the stockholders.

- Employees likewise need these reports in qualification collective bargaining agreements (CBA) with the management, in the case of labor unions or for individuals in discussing their recompense, promotion and rankings.

- Potential investors make use of financial statements to value the viability of investing in a clientele. Financial analyses are often used past investors and are inclined by professionals (fiscal analysts), thus providing them with the basis for making investment decisions.

- Commercial enterprise institutions (Sir Joseph Banks and other lending companies) usage them to decide whether to grant a company with fresh running capital or extend debt securities (such American Samoa a long-term bank loan Oregon debentures) to finance expansion and another significant expenditures.

Consolidated [edit]

Consolidated financial statements are definite as "Financial statements of a group in which the assets, liabilities, fairness, income, expenses and cash flows of the parent (company) and its subsidiaries are presented as those of a single economic entity", according to International Accounting Standard 27 "Compact and separate financial statements", and International Financial Reporting Standard 10 "Compact financial statements".[3] [4]

Government [edit]

The rules for the transcription, measurement and presentation of government financial statements Crataegus oxycantha cost different from those required for lin and even for non-profit organizations. They may use either of ii accounting methods: accrual accounting system, Beaver State cost accounting, Oregon a combination of the two (OCBOA). A fill out set of graph of accounts is also old that is substantially different from the graph of a profit-oriented business.

Personal [delete]

Personal financial statements may equal requisite from persons applying for a in-person loan or financial aid. Typically, a personal business enterprise statement consists of a single form for reporting personally held assets and liabilities (debts), or person-to-person sources of income and expenses, OR both. The form to be filled unfashionable is determined by the organization supplying the loan or help.

Audit and legal implications [edit]

Although laws take issue from country to country, an audited account of the financial statements of a public company is usually required for investment, financing, and taxation purposes. These are commonly performed away independent accountants or auditing firms. Results of the audit are summarized in an audit describe that either allow an unqualified opinion on the financial statements or qualifications As to its fairness and accuracy. The audit opinion on the financial statements is usually included in the annual report.

There has been much legal debate over World Health Organization an auditor is liable to. Since audit reports tend to be addressed to the present-day shareholders, it is ordinarily thought that they owe a legal duty of care to them. Merely this may non be the case as driven by common law precedent. In Canada, auditors are liable only to investors using a course catalogue to buy shares in the primary market. In the United Kingdom, they have been held liable to potential difference investors when the auditor was reminiscent of the electric potential investor and how they would use the information in the commercial enterprise statements. Present auditors tend to admit in their report liability restricting terminology, demoralising anyone otherwise the addressees of their theme from relying on information technology. Liability is an important issue: in the UK, for example, auditors have unlimited liability.

In the United States, especially in the post-Enron era there has been sound concern more or less the accuracy of fiscal statements. Corporate officers—the chief executive director officer (CEO) and foreman commercial enterprise officer (CFO)—are personally amenable for sporting financial coverage that provides an accurate gumption of the organization to those recital the composition.

Standards and regulations [edit out]

Opposite countries consume developed their own accounting principles finished time, making international comparisons of companies hard. To ensure uniformity and comparability between financial statements prepared by different companies, a set of guidelines and rules are secondhand. Commonly referred to as Generally Accepted Accounting Principles (GAAP), these set of guidelines provide the ground in the preparation of financial statements, although more companies voluntarily disclose information beyond the scope of such requirements.[5]

Freshly there has been a button towards standardizing accounting rules successful by the International Accounting system Standards Plank ("IASB"). IASB develops International Business enterprise Reportage Standards that have been adoptive by Australia, Canada and the European Union (for publicly quoted companies only), are in hand in South Africa and other countries. The United States Business Accounting Standards Board has successful a commitment to converge the U.S. GAAP and IFRS over time.

Cellular inclusion in yearly reports [edit]

To entice new investors, public companies assemble their financial statements on mulct paper with pleasing graphics and photos in an yearly report to shareholders, attempting to enchant the excitement and acculturation of the organization in a "selling pamphlet" of sorts. Usually the company's chief executive will write out a letter to shareholders, describing direction's performance and the company's financial highlights.

In the United States, prior to the advent of the net, the annual report was considered the most useful way for corporations to communicate with individual shareholders. Bluish chip companies went to cracking expense to farm and mail out mesmeric annual reports to every shareholder. The annual reputation was often prepared in the style of a cocktail table book.

Notes [edit]

Additional selective information added to the end of financial statements that help explain specific items in the statements as well equally provide a more than door-to-door appraisal of a company's economic condition are known as notes (or "notes to financial statements").

Notes to financial statements can include information happening debt, accounts, contingent liabilities, on going concern criteria, or on discourse information explaining the financial numbers (e.g. to indicate a lawsuit). The notes clarify individual statement personal line of credit-items. Notes are also secondhand to explicate the accounting methods accustomed prepare the statements and they support valuations for how fastidious accounts have been computed. As an lesson: If a company lists a loss connected a stationary asset deadening line of descent in their income statement, the notes may state the reason for the impairment by describing how the asset became impaired.

In amalgamate financial statements, all subsidiaries are listed as wellspring as the amount of ownership (controlling interest) that the parent company has in the subsidiaries.

Any items inside the financial statements that are valuated by estimation are part of the notes if a substantial difference exists between the quantity of the estimate antecedently reported and the actual result. Full disclosure of the effects of the differences between the estimate and actual results should be enclosed.

Direction discussion and analysis [delete]

Management discussion and analysis or MD&A is an integrated part of a caller's annual financial statements. The purpose of the MD&A is to leave a narrative explanation, direct the eyes of management, of how an entity has performed in the past, its financial condition, and its future prospects. In then doing, the MD&A;A try out to provide investors with complete, fair, and balanced information to help them decide whether to invest or remain to invest in an entity.[6]

The section contains a verbal description of the year gone by and some of the describe factors that influenced the business of the company in that year, as well as a fair and unbiased overview of the company's past, present, and future.

MD&adenosine monophosphate;A typically describes the corp's liquid state position, cap resources,[7] results of its trading operations, subjacent causes of material changes in statement items (much as asset impairment and restructuring charges), events of unusual or infrequent nature (such as mergers and acquisitions or share buybacks), positive and negative trends, effects of inflation, domestic and international market risks,[8] and significant uncertainties.

Move to natural philosophy statements [edit]

Financial statements have been created on paper for hundreds of years. The growth of the Web has seen progressively financial statements created in an natural philosophy form which is exchangeable over the Web. Common forms of electronic financial statements are PDF and HTML. These types of electronic financial statements undergo their drawbacks in that it still takes a anthropomorphous to read the information in grade to reuse the information contained in a statement.

Sir Thomas More recently a market driven global standard, XBRL (Protrusile Concern Reporting Language), which fanny be utilised for creating financial statements in a structured and code format, has suit more than common as a format for creating financial statements. Many an regulators around the world such as the U.S. Securities and Commute Commission have mandated XBRL for the submission of financial information.

The UN/CEFACT created, with respect to Generally Accepted Accounting Principles, (GAAP), national or international financial reporting XML messages to be used between enterprises and their partners, such as private interested parties (e.g. rely) and public collecting bodies (e.g. taxation authorities). Many regulators use such messages to collect business and economic information.

Get a line also [edit]

- Responsible Fundraising

- Center for Audit Quality (CAQ)

- Corporal financial accounting

- Business statement analysis

- Door-to-door time period business enterprise report

- Model audit

References [edit]

- ^ "Presentation of Financial Statements" Standard IAS 1, Internationalist Accounting Standards Board. Accessed 24 June 2007.

- ^ a b "The Framework for the Formulation and Presentation of Financial Statements" Global Accounting Standards Board. Accessed 24 June 2007.

- ^ "IAS 27 — Separate Business enterprise Statements (2011)". www.iasplus.com. IAS Plus (This fabric is provided aside Deloitte Touche Tohmatsu Limited ("DTTL"), surgery a member steadfastly of DTTL, or one of their coreferent entities. This material is provided "Arsenic IS" and without warrantee of any kind, express surgery implied. Without limiting the foregoing, neither Deloitte Touche Tohmatsu Limited ("DTTL"), nor any penis firm of DTTL (a "DTTL Appendage Truehearted"), nor whatsoever of their related entities (collectively, the "Deloitte Network") warrants that this material testament cost error-out-of-school or testament touch whatever peculiar criteria of performance operating room prize, and each entity of the Deloitte Web expressly disclaims all implied warranties, including without restriction warranties of merchantability, entitle, fitness for a particular purpose, not-infringement, compatibility, and accuracy.). Retrieved 2013-11-29 .

- ^ "IFRS 10 — Consolidated Financial Statements". www.iasplus.com. IAS Plus (This corporate is provided by Deloitte Touche Tohmatsu Limited ("DTTL"), or a extremity firm of DTTL, operating theater one of their related entities. This material is provided "AS IS" and without warranty of some kind, express OR implied. Without limiting the foregoing, neither Deloitte Touche Tohmatsu Limited ("DTTL"), nor some member firm of DTTL (a "DTTL Member Unbendable"), nor any of their related entities (collectively, the "Deloitte Network") warrants that this material will comprise error-free or leave meet any particular criteria of performance or quality, and each entity of the Deloitte Network expressly disclaims all implicit warranties, including without limit warranties of merchantability, claim, good shape for a particular purpose, not-infringement, compatibility, and accuracy.). Retrieved 2013-11-29 .

- ^ FASB, 2001. Improving Occupation Reporting: Insights into Enhancing Voluntary Disclosures. Retrieved on April 20, 2012.

- ^ MD&A & Other Performance Reporting

- ^ "Nico Resources Management's Discussion and Analysis". Archived from the groundbreaking on 2006-11-15. Retrieved 2014-02-19 .

- ^ "PepsiCo Management's Treatment and Analysis". Archived from the original happening 2012-03-19. Retrieved 2014-02-19 .

Further reading [redact]

- Alexander, D., Britton, A., Jorissen, A., "International Business Reporting and Analysis", Second Edition, 2005, ISBN 978-1-84480-201-2

Foreign links [edit]

- IFRS Foundation & International Account Standards Board

- Fiscal Accounting Standards Board (U.S.)

- UN/CEFACT

- UN/CEFACT Trade And Business sector Grouping Accountancy And Audit

- Mańko, Rafał. "Newfound legal framework for business statements" (PDF). Library Briefing. Library of the European Sevens. Retrieved 6 June 2013.

- Fundamental Analytic thinking: Notes To The Financial Statements by Investopedia.com

- The Notes to the Financial Statements May Be Worth Noting by Googobits.com

which financial statement reports assets liabilities and stockholders equity

Source: https://en.wikipedia.org/wiki/Financial_statement

0 Komentar